How To Edit An Invoice Using ResBook PMS

An invoice can be altered and further details can be supplied before it gets sent to the guest/agent.

According to the Tax code in Invoice Settings , all invoices will say:

- 'Tax Invoice' if it the Tax code is GST registered OR

- 'Invoice' if no Tax code is registered

Here is an example:

- An order number serves as a reference for the business and its guest

- The invoice due date is automatically generated by the setting applied under Invoice Settings

- Invoice Title will appear under the word 'Tax Invoice' or 'Invoice' when you print or e-mail invoices in pdf.

- Invoices Notes applies to individual invoices. These notes will appear under the mandatory Invoice notes as supplied in the Invoice Settings when you print or e-mail invoices in pdf.

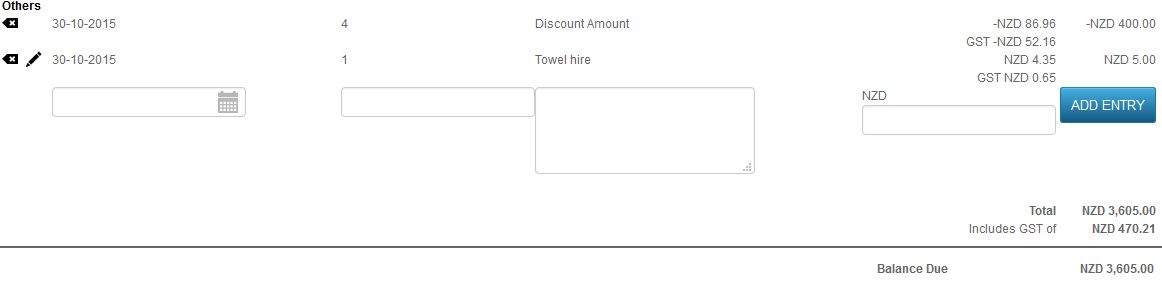

Apart from the discount which will be recorded under "Others" section, other information can also be supplied by filling in the fields. Check out the Towel hire example below:

The entry is editable by clicking on the pencil.

To delete an entry, click on the [x] of the entry and [OK] to delete:

If you have made a mistake in deleting the entries from the invoice, do not fret. Simply click on the Import buttons to repopulate the information back into the invoice:

Remember that your Booking should reflect all services/payments and booking information as accurately as possible. Invoices can be manipulated at any time to suit the preferences of the guests/agents. Instances where you would encounter this:

- Split payment for the guest(s) staying at the property

- Split payment using different credit cards

- On-charging the service to the agent

Any changes made to the Invoice should be Saved.

Note: If your ResBook PMS is connected to Xero, then rules will apply differently for Invoices.