How To Access Your Invoice Settings In ResBook PMS

All invoices will display information that is controlled in the Invoices module (Invoices > Settings)

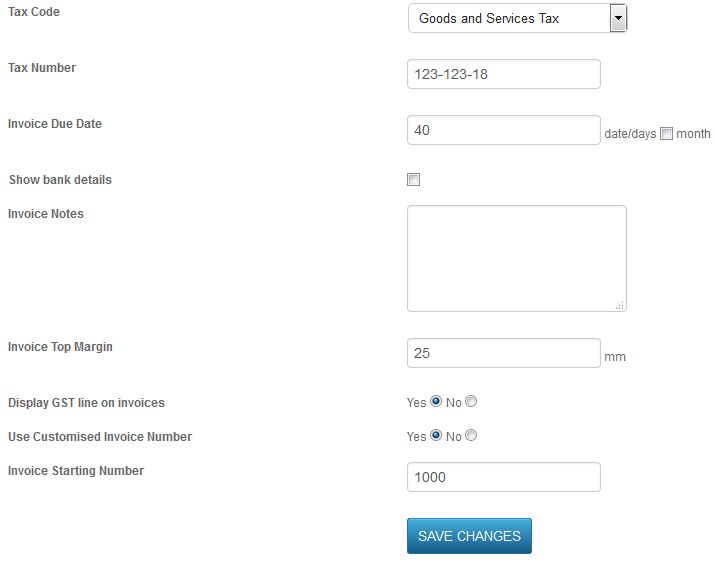

Tax Code: The same setting is also found in the Accounting and Financial Settings of ResBook PMS.

Tax Number: The tax number that is unique to your business.

Invoice due date: When an invoice is generated, the due date will be calculated according to the number supplied in this field.

Show bank details: When this box is checked, it will be displayed on all invoice pdf.

Invoice Notes: This will show up at the bottom of the Invoice pdf file.

Invoice Top Margin: This is not in use.

Display GST line on invoices: Select 'yes' and we will display GST in the invoice. Select 'no' and GST will be hidden.

Use Customised Invoice Number: Users can start creating an invoice sequence based on the customized numeric code.

*Please note that this will take effect from the day the settings are activated only. Previous invoice number/ code and sequence will not be affected.

Invoice Starting Number: This is the starting number for invoices being sent to Xero. This acts as a reference for the ResBook PMS user to consolidate their data in Xero.